Bitcoin and Ether Rally Despite Mixed Fed Messages

[ad_1]

Fed minutes from the Nov. 2022 Federal Open Markets Committee Meeting reveal that most Fed officials see rate hikes softening soon.

However, some officials noted that the terminal rate, i.e., the rate at which inflation is expected to reach the Fed’s target of around 2%, was higher than previously expected.

Fed minutes cause major indexes and crypto to rally

After the minutes were released, the S&P 500 inched 0.4% higher. Treasury yields dropped, and the Dow Jones Industrial Average rose 0.2%. The Nasdaq spiked 0.7%.

“Looking through the Minutes there is nothing terribly surprising with officials suggesting that slowing the pace of right hikes would allow the Fed to better assess progress towards its goals ‘given the uncertain lags’ associated with monetary policy,” said Michael Reinking, an NYSE market strategist.

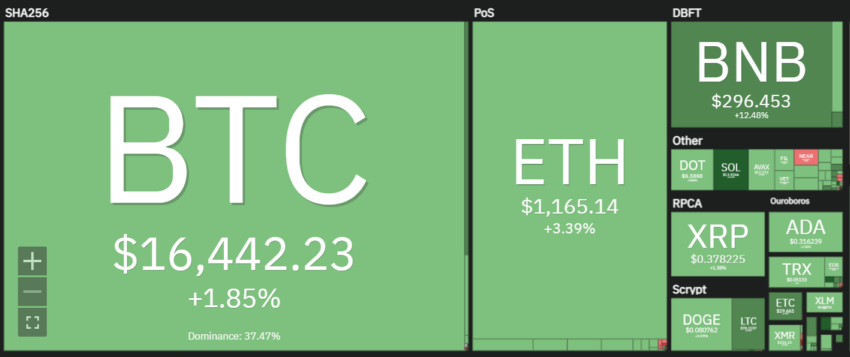

Bitcoin responded positively to the news, up almost 3% to around $16,700 in the last 24 hours, with Ethereum surging 4.75% to exchange hands at $1,177.52.

Top-10 memecoin Doge rose 4.8% to $0.082, while BNB went up by 13.2%.

Though Fed minutes are generally outdated, as stock markets have already absorbed the outcome of the previous meeting, they reveal the Fed’s outlook on the U.S. economy and provide insight into the bank’s future actions.

Fed officials decry the uncertain ‘lag’ in economic response

The minutes come on the back of U.S. employment data released on Nov. 19, 2022, revealing signs of a slowdown in hiring. The week ended Nov. 19, 2022, saw 240,000 unemployment claims, above estimates of 225,000. This comes as tech and crypto-related layoffs flood the news, stabilizing the balance between job supply and demand.

A lower month-on-month core Consumer Price Index in Oct. 2022 compared to Sep. 2022 also showed signs of cooling inflation. However, meeting participants still feel it is too high and predicted that lower-than-expected GDP growth would help balance supply and demand.

“With inflation remaining far too high and showing few signs of moderating, participants observed that a period of below-trend real GDP growth would be helpful in bringing aggregate supply and aggregate demand into better balance, reducing inflationary pressures, and setting the stage for the sustained achievement of the Committee’s objectives of maximum employment and price stability, ” the report reads.

The committee also admitted that despite signs of the Fed’s interest rate hike policy affecting prices, it is still challenging to predict the lag between Fed action and economic response.

Fed minutes roils analyst

Technical analyst Sven Henrich points out the glaring omission of any reference to a 2023 recession in the Fed minutes, slamming the organization for being dishonest.

Indeed, the growing negative spread in treasury yields has been a predictor of previous recessions. A recession could come in Q1 of 2023, but only be made official in Q2 or Q3. Earlier this month, the difference between 10Y and 3M yields was around -0.4%.

“Recession looks more and more likely for the upcoming year and if the Fed responds accordingly [slower hikes], a recession may turn out to be short and shallow,” said Jeffrey Roach of LPL Financial.

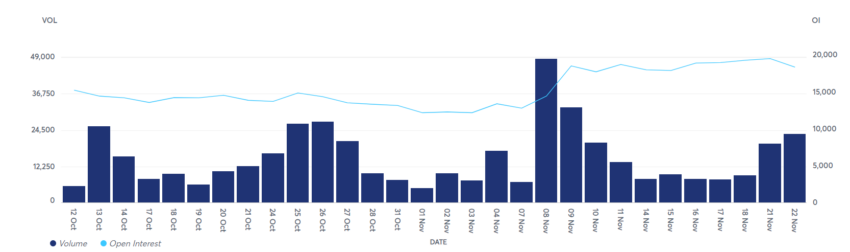

Despite the recent Bitcoin price increase, open interest on CME’s Bitcoin futures contracts is surging as Wall Street continues to bet on the decline in the price of Bitcoin.

Some analysts believe will touch the $10,000 mark before the end of 2022. At press time, the world’s largest crypto had shed earlier gains, and is down 0.5% to below $16,500.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link