Bitcoin Price and Ethereum Prediction, FTT Drops 90% Over FTX Bankruptcy & Hack

[ad_1]

Bitcoin is down nearly 1.5% to $16,800 as a result of the FTX bankruptcy, which has caused market chaos and risk-off sentiment. Ethereum, the second most valuable cryptocurrency, on the other hand, has gained over 1.5% to trade at $1,264.

Bitcoin is down nearly 1.5% to $16,800 as a result of the FTX bankruptcy, which has caused market chaos and risk-off sentiment. Ethereum, the second most valuable cryptocurrency, on the other hand, has gained over 1.5% to trade at $1,264.

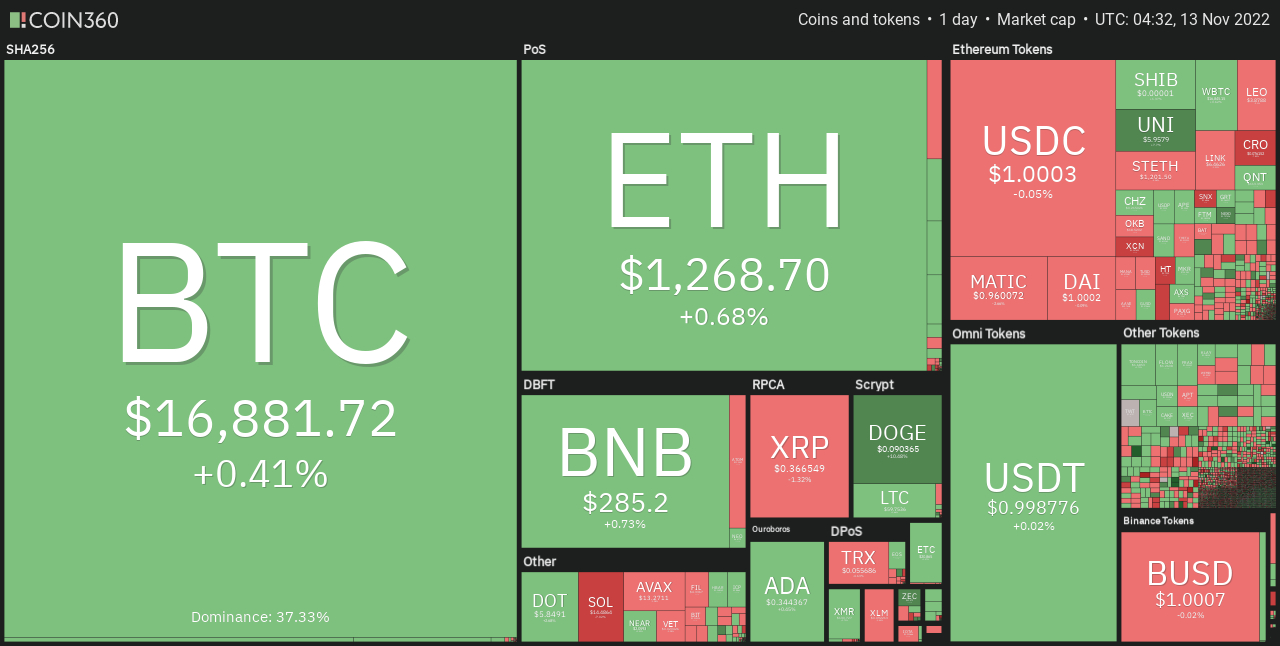

Major cryptocurrencies were trading in the negative early on November 13, as the global crypto market cap fell 2% on the previous day to $855 billion. Over the last 24 hours, total crypto market volume fell 33% to $96.72 billion.

The overall volume in DeFi was $4.46 billion, accounting for 4.5 of the total 24-hour volume in the crypto market. The overall volume of all stablecoins was $91.30 billion, accounting for 94.40 percent of the total 24-hour volume of the crypto market.

Let’s take a look at the top altcoin gainers and losers over the last 24 hours.

Top Altcoin Gainers and Losers

Three of the top 100 coins that have gained value in the last 24 hours are Chain (XCN), GMX (GMX), and Bitcoin SV (BSV). The XCN recovered more than 6% to $36.23, the GMX gained more than 6% to $36.20, and the BSV gained nearly 3.5%.

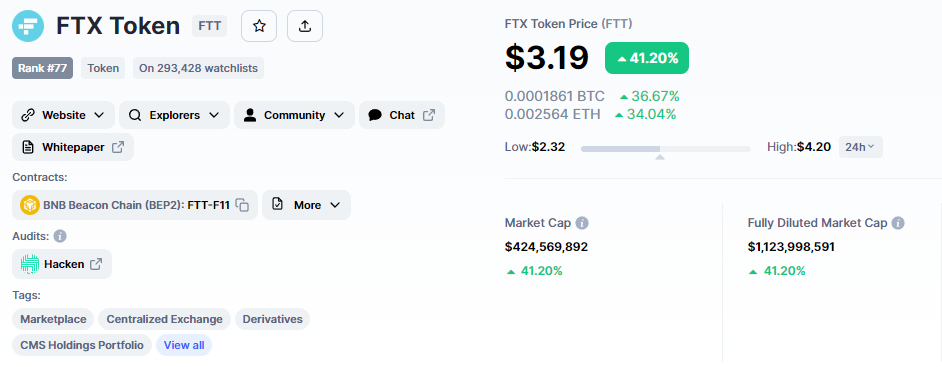

FTX Token (FTT) has lost more than 30% of its value in the last 24 hours and over 90% in seven days to trade at $2.26. ImmutableX (IMX) and Maker (MKR) are down over 13% to $0.4108 and $709, respectively.

FTX Dumps 90% in Seven Days

The current FTX Token price is $2.35, and the 24-hour trading volume is $617 million. In the last 24 hours, FTX Token has dropped 30%. With a live market cap of $312 million, CoinMarketCap now ranks #92. There are 133,025,776 FTT coins in circulation, with a maximum supply of 352,170,015 FTT coins.

After an unprecedented week of corporate drama that rocked crypto markets, sent shock waves through an industry fighting for mainstream credibility, and prompted government investigations that could lead to more damaging revelations or even criminal charges, FTX announced on Friday that it was filing for bankruptcy.

The corporation announced Mr. Bankman-resignation Fried’s in a tweet and named corporate turnaround expert John J. Ray III as the new CEO. Crypto experts are taken aback by the lightning speed of FTX’s decline.

Only a few short days ago, Mr. Bankman-Fried was widely regarded as one of the crypto industry’s brightest leaders, a powerful player in Washington who was working to set rules. And FTX was generally regarded as one of the most reliable and trustworthy firms in the otherwise unrestricted cryptocurrency market.

As a result of FTX’s bankruptcy filing, the value of Bankman-possessions Fried’s dropped to zero in a matter of days, according to the Bloomberg Asset Price Index.

Crypto Exchange FTX Hacked

After the exchange declared bankruptcy, analysts claimed hundreds of millions of dollars worth of crypto assets were removed, prompting FTX to say it is inspecting irregular transactions.

Cryptocurrency exchange FTX announced via its official Telegram channel that it had been hacked, and encouraged customers to uninstall any and all FTX apps.

The story claims that more than $600 million was stolen from the FTX and FTX US exchanges on Friday night, suggesting that the exchanges’ wallets were compromised.

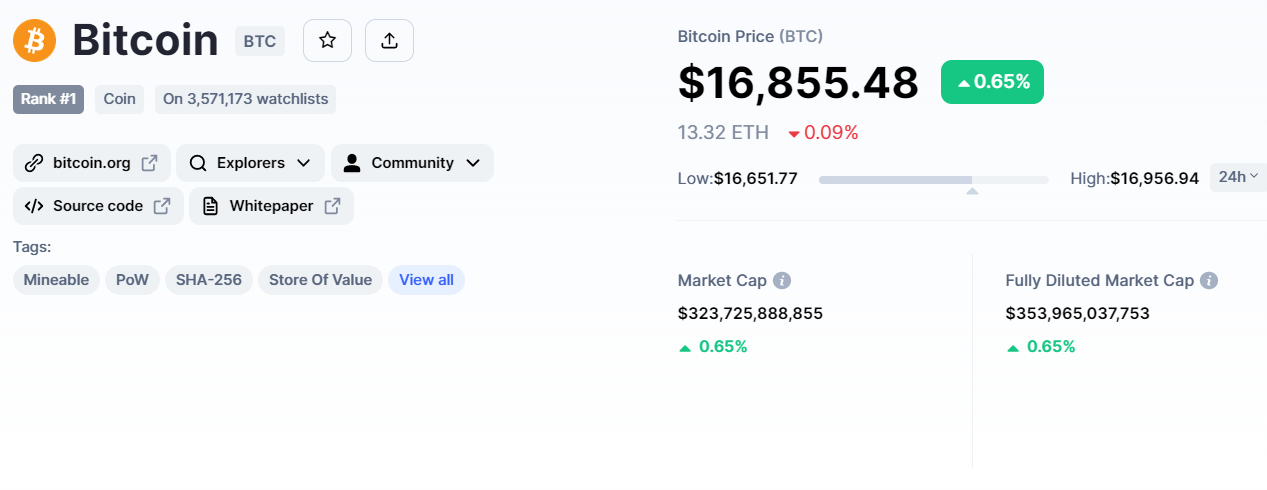

Bitcoin Price

The current Bitcoin price is $17,305 and the 24-hour trading volume is $75 billion. Bitcoin gained over 4% during the Asian session amid weaker US CPI figures. CoinMarketCap currently ranks it first, with a live market cap of $359 billion, up from $314 billion yesterday.

Bitcoin is consolidating in a broad trading range of $18,000 to 16,000 marks and a breakout will determine future price action.

On the 4-hour timeframe, Bitcoin has completed 38.2% Fibonacci retracement at the $18,100 level, and under this, BTC is steady.

A bullish crossover above $18,100 this level could expose the BTC price to a 61.8% Fibonacci level of $19,350.

If Bitcoin does not break through the 38.2% Fibonacci retracement level of $18.250, it may fall back below $15,965.

The MACD, a leading technical indicator, has moved into the buying zone, while the 50-day moving average (blue line) and RSI are still in the selling zone.

If the closing candles fall below $18,000, BTC could continue to fall, with support at $16,000 and 15,850.

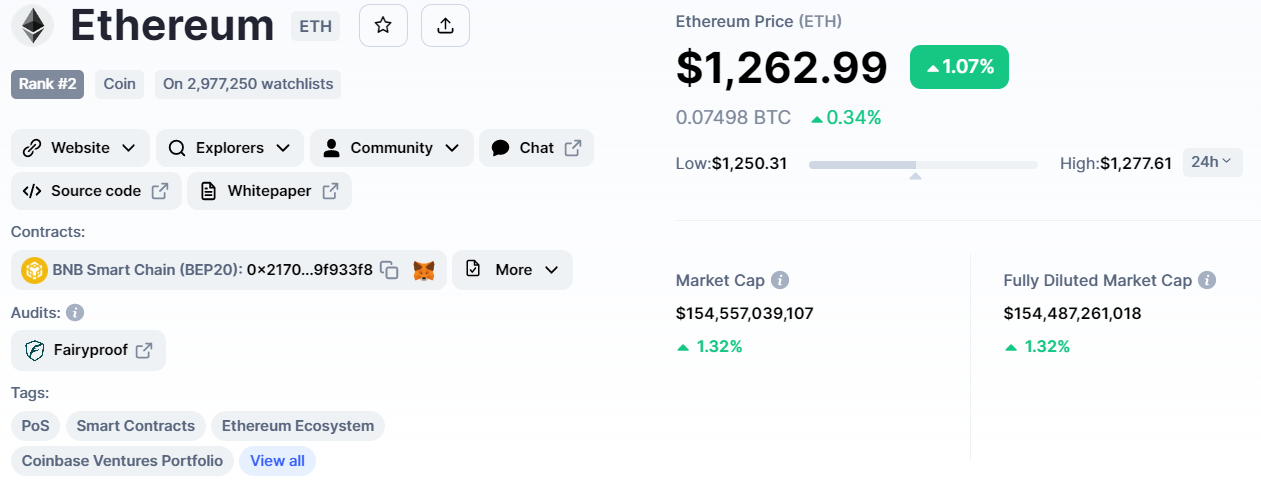

Ethereum Price

On Friday, the second-most valuable cryptocurrency, Ethereum, recovered 1% in the previous 24 hours to $1,262. On CoinMarketCap, it is now ranked second, with a live market capitalization of $154 billion.

Due to a bullish retracement, Ethereum has reclaimed the $1,262 level on the daily chart. The immediate resistance level for Ethereum is $1,370, which is supported by a 50-day moving average.

A bullish crossover above $1,370 could push the recovery all the way to $1,506 or $1,670.

Support is still around $1,170 or $1,095. A break below this level could expose ETH to $1,000 or $881, but this appears unlikely at the moment.

New Crypto Presale With Huge Potential

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data, allowing them to make more informed decisions.

It began its token sale three weeks ago and has since raised more than $6 million, while also confirming its first CEX listing on LBank exchange.

1 D2T is currently worth 0.0513 USDT, but this is expected to rise to $0.0533 in the next stage of sales and $0.0662 in the final stage.

Visit Dash 2 Trade now

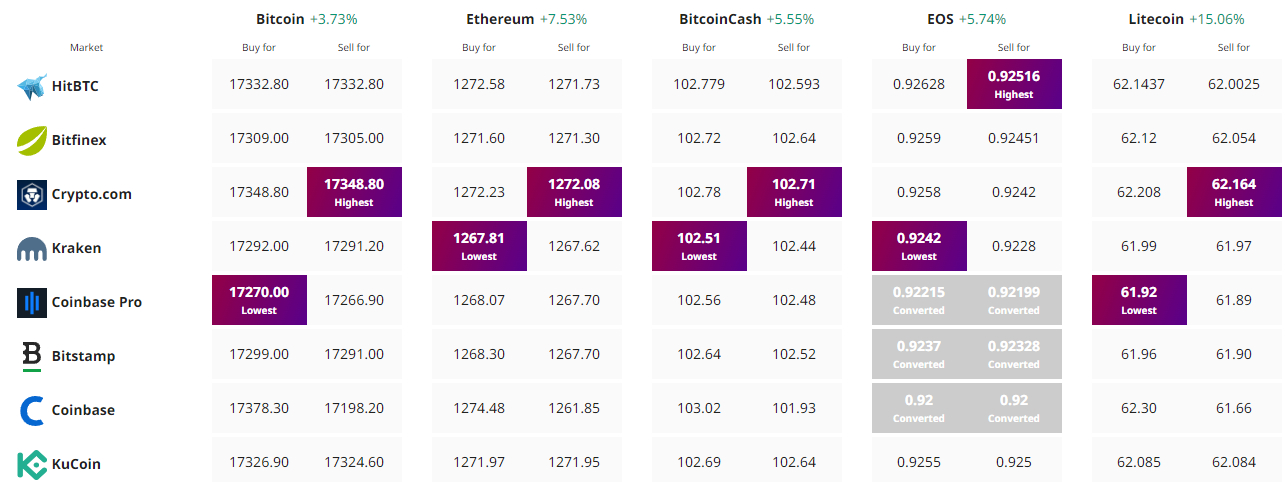

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

Source link