Bitcoin Price and Ethereum Prediction; Hot US NFP Backs the Fed’s Call for Higher Rates

[ad_1]

On December 3, Bitcoin, the leading cryptocurrency, struggled to break above the $17,250 level, and it is now heading lower to $16,900. Similarly, Ethereum, the second-most valuable cryptocurrency, has fallen after being rejected at $1,300 and is now consolidating near $1,275.

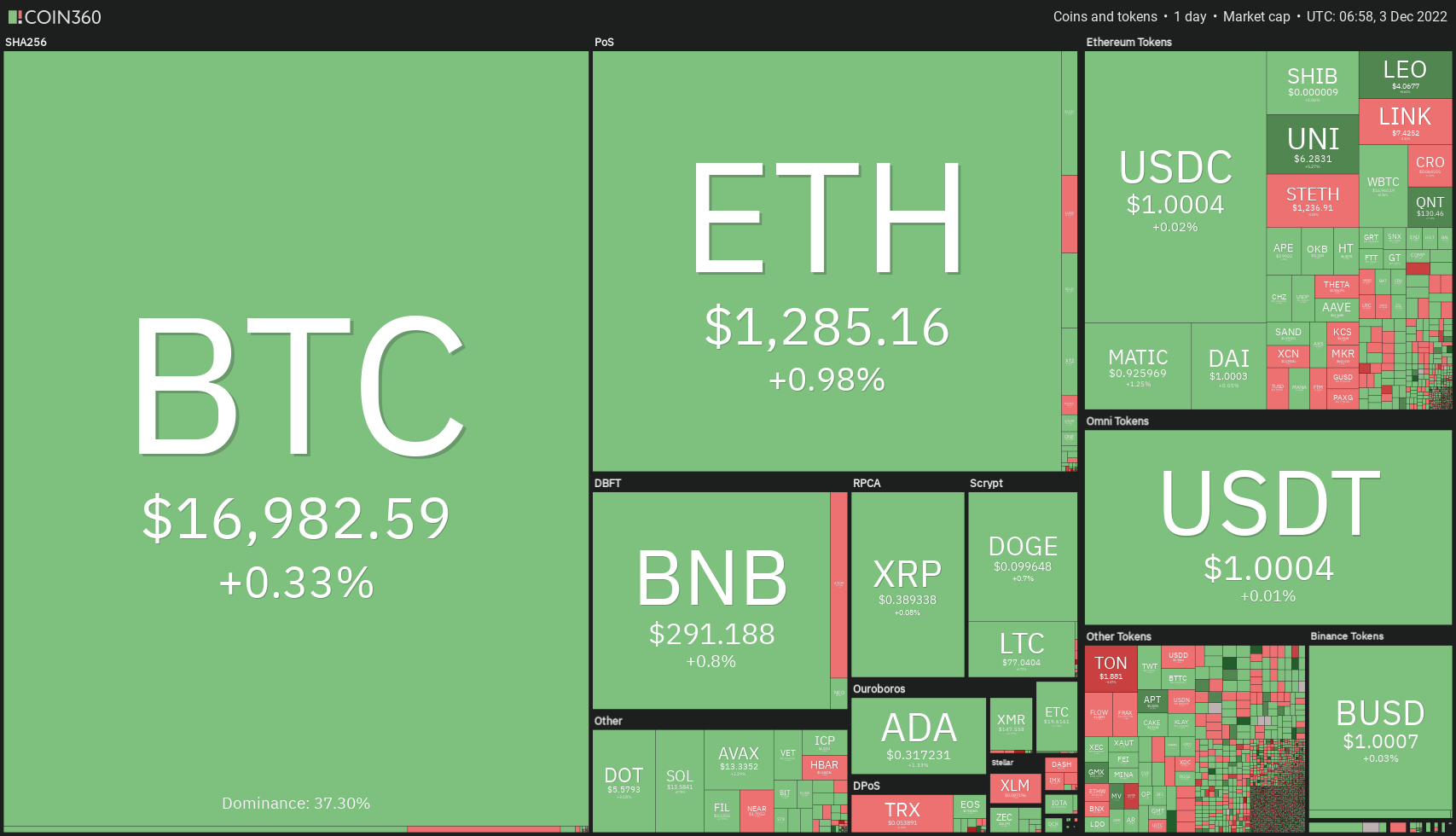

On December 3, major cryptocurrencies were mostly trading in the green, with the global crypto market cap up 0.92% to $859.91 billion over the previous day. Over the last 24 hours, overall crypto market volume fell over 12% to $89.31 billion. The entire cryptocurrency market volume in the last 24 hours is $38.08 billion, a 10% fall.

The overall volume in DeFi is currently $2.84 billion, accounting for 7.5% of the entire 24-hour volume in the crypto market. The overall volume of all stablecoins is now $35.45 billion, accounting for 93% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Three of the top 100 coins that have gained value in the last 24 hours are Aptos (APT), Quant (QNT), and UNUS SED LEO (LEO). The price of APT has increased by more than 8% to $4, the price of QNT has increased by more than 7.5% to $130, and the price of LEO has increased by nearly 5%.

Loopring (LRC), EthereumPoW (ETHW), and Terra Classic (LUNC) are three of the top 100 coins that have lost value in the last 24 hours. Whereas LRC has lost about 3% to trade at $0.2535, ETHW is down nearly 3.5% to trade at $3.85. At the same time, the LUNC price is down over 4% to trade at $0.00017.

Hot US NFP Backs the Fed’s Call for Higher Rates

Wage growth and job creation have been strong indicators that the Federal Reserve has to do more to bring inflation under control. The market was undoubtedly shaken up by this. However, market players will remain skeptical regarding how long the robust performance can hold due to persistent recessionary risks.

Even with a 23,000 downward revision to the preceding two months’ figures, the US economy added 263,000 jobs in November, far exceeding the 200,000 consensus expectation. The leisure and hospitality sectors added 88,000 jobs, while the education and health sectors added 82,000.

The construction industry saw an increase of 20,000, while the manufacturing sector saw an increase of 14,000. Retail and wholesale trade both had declines (-49,000), though (-30,000).

Worker morale was bolstered further by larger-than-anticipated monthly wage rises of 0.6%, bringing the annual rate of wage growth to 5.1%. Despite a second straight reduction in the number of persons who said they were employed (this time by 138,000), the unemployment rate stayed unchanged at 3.7%, according to a survey of households.

The unemployment rate remained unchanged because fewer people are choosing to participate in the labor force. Officials at the Fed will be hoping that today’s statistics will be the jolt needed to encourage market players to finally believe the Fed’s intent, given the repeated warnings that rates are likely to stay higher for longer to guarantee inflation is defeated.

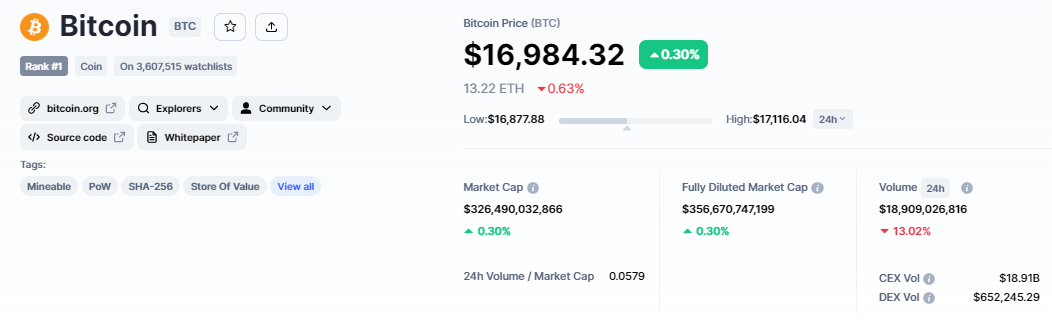

Bitcoin Price

The current Bitcoin price is $16,986, and the 24-hour trading volume is $18 billion. During the last 24 hours, the BTC/USD pair has gained above 0.50%, while CoinMarketCap currently ranks first with a live market cap of $356 billion, down from $358 billion yesterday.

It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,223,025 BTC coins.

The BTC/USD pair has struggled to break through the $17,250 level, and the closing of doji and spinning top candles suggests a bearish correction.

On the downside, Bitcoin has completed a 23.6% Fibonacci retracement at $16,900, and closing candles below $16,950 may prompt fresh selling until the $16,750 barrier is reached.

Further down, Bitcoin can target the $16,600 level, which is a 50% Fib extension, and a break below this can expose BTC to the $16,450 level, which is a 61.8% Fib extension.

On the upside, a bullish breakout of the $17,250 barrier might expose BTC to levels as high as 17,650 and $18,100.

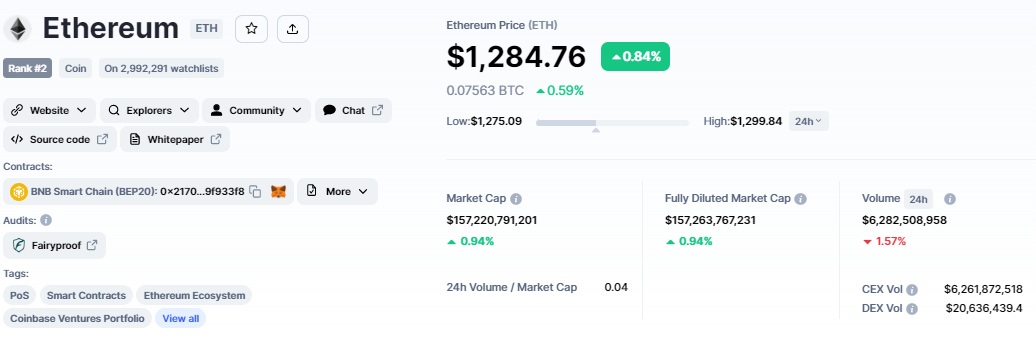

Ethereum Price

The current price of Ethereum is $1,285, with a 24-hour trading volume of $6 billion. In the last 24 hours, Ethereum has gained nearly 1%. CoinMarketCap currently ranks #2, with a live market cap of $157 billion. It has a circulating supply of 122,373,866 ETH coins.

On the 4-hour chart, Ethereum traded bullishly but failed to break over the $1,310 resistance level, signaling the start of a negative correction. The tweezers top formation is undermining the bullish trend and could lead to a bearish market correction.

Ethereum’s immediate support is anticipated to be around $1,225, with a dip below $1,150 probable.

Since the MACD is in a selling zone while the RSI is still in a purchasing zone, the two indicators are diverging. Furthermore, the 50-day simple moving average (SMA) continues to indicate a purchasing trend.

In contrast, a bullish breakout of the $1,310 level could expose the ETH price to the $1,354 level.

Presale Cryptocurrency With Massive Profit Potential

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data, allowing them to make better-informed decisions. The platform will go live in the first quarter of 2023, providing information to investors to assist them in making proactive trading decisions.

Dash 2 Trade has also been a success, with two exchanges (LBank and BitMart) promising to list the D2T token after the presale concludes. 1 D2T is currently worth 0.0513 USDT, but this will increase to $0.0533 at the end of the sale. D2T has so far raised more than $7.8 million by selling more than 91% of its tokens.

Visit Dash 2 Trade now

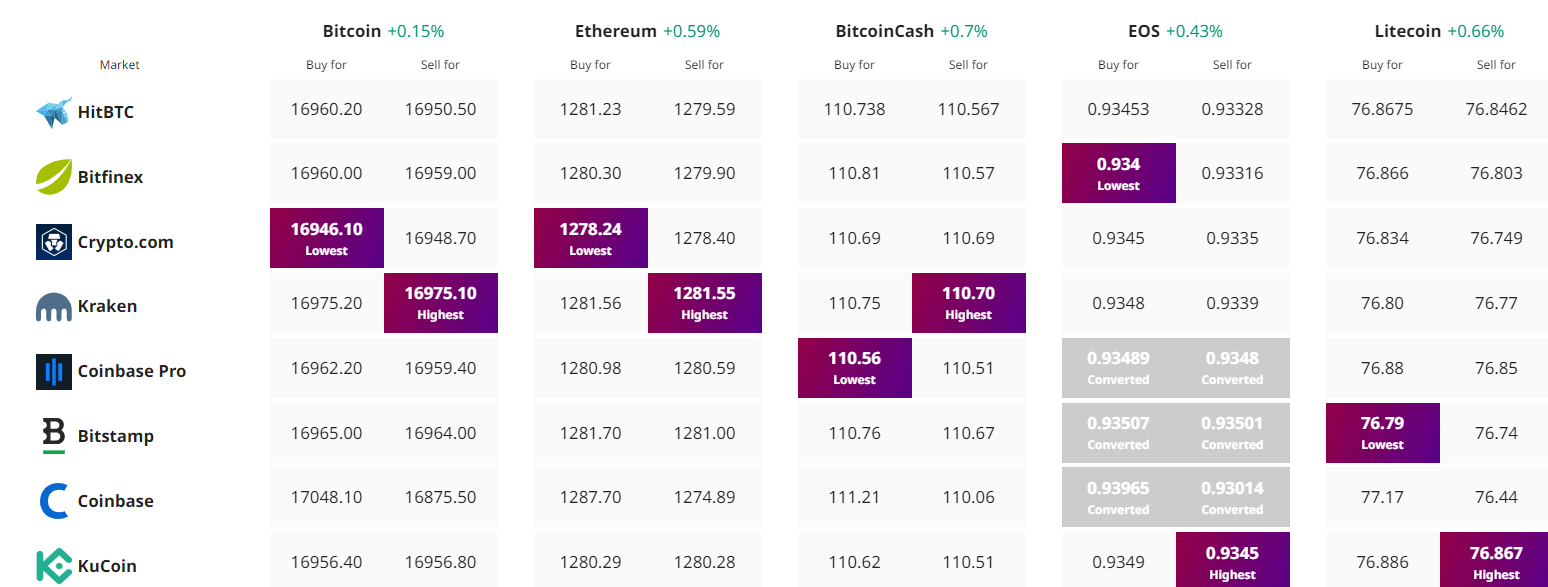

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

Source link