Bitcoin Spot & Derivative Trading Volumes Surge – Bullish for the BTC Price?

[ad_1]

Bitcoin spot and derivative trading volumes have been surging in the past few weeks in tandem with the cryptocurrency’s aggressive rally from early monthly lows under $20,000.

That suggests there is a lot of conviction behind the recent move higher, which saw Bitcoin eclipse $28,000 this week for the first time in nine months.

At current levels in the mid-$28,000s, Bitcoin is up nearly 4% in the last 24 hours, 13.5% in the last seven days and 19% in the last 30 days according to CoinGecko.

Bitcoin’s price has been supporting since mid-March amid concerns about US (and global) financial stability following a series of highly publicized bank failures, as well as thanks to an associated dovish pivot from the US Federal Reserve.

Despite still raising interest rates by another 25 bps this week given inflation is still raging well above target, the US central bank softened its tone on the outlook for further interest rate hikes, and markets are betting aggressively on the start of a rate-cutting cycle starting in the second half of 2022.

Spot & Derivative Volumes Surge in Bull Market Tell

The latest surge in Bitcoin trading volumes adds to the reasons to think that a new Bitcoin bull market has arrived.

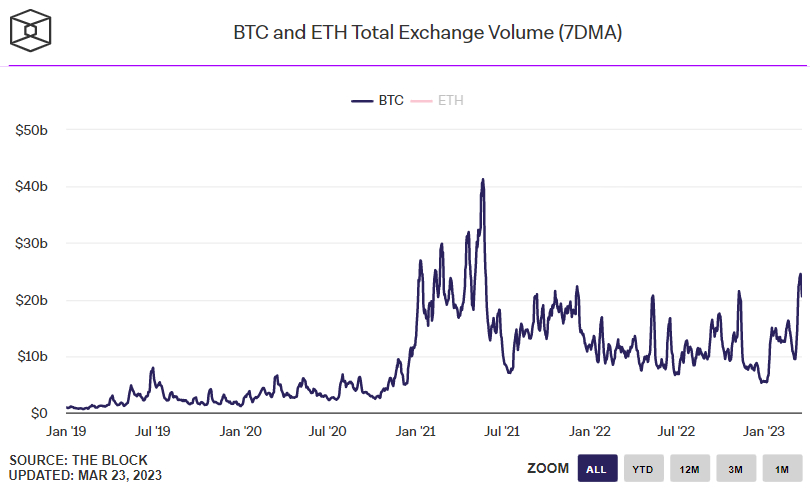

According to data presented by The Block, the 7-day Moving Average of Bitcoin trading volumes on exchanges rose to around $24 billion earlier this week, its highest level since mid-2021.

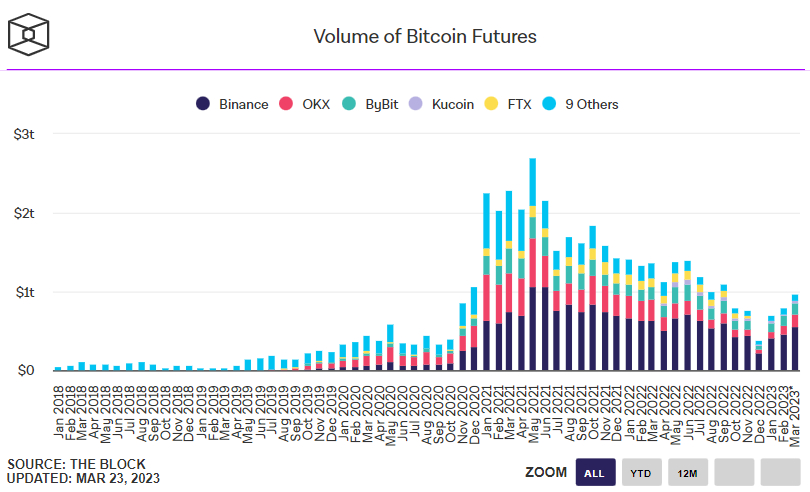

Meanwhile, despite March not being over yet, the volume of Bitcoin futures traded across exchanges this month so far is already at its highest since last September at close to $1 trillion.

It will probably end the month at its highest since last July or June. Bitcoin futures are a derivative of the underlying spot Bitcoin asset.

Futures represent a guarantee that an asset will be delivered at some time in the future. Industrial businesses trade commodity futures to secure their supply of raw materials, but futures are also used for speculation, as in the case of Bitcoin.

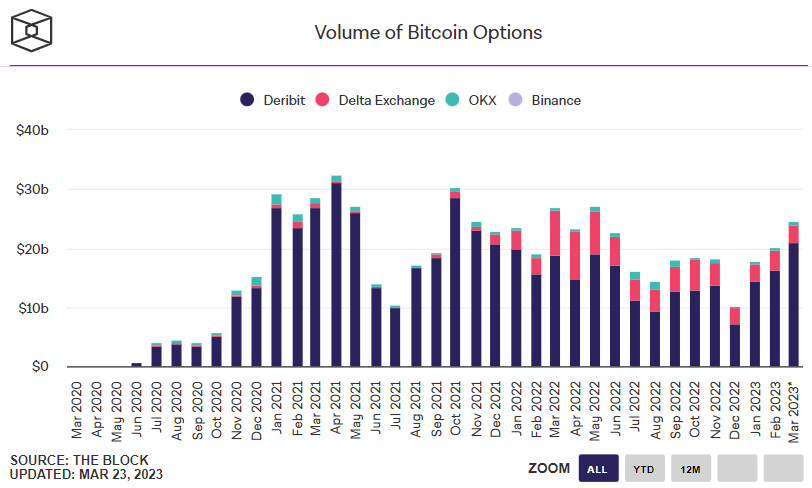

Bitcoin options market volumes have also been surging this month. Despite the month not yet being over, March has already seen more Bitcoin options trade than any month since last May (at nearly $25 billion).

Investors use Bitcoin options to bet on or hedge against price swings. Given they are a more sophisticated asset class to understand and trade, institutions and professional trading desks make up a greater proportion of overall trading volumes.

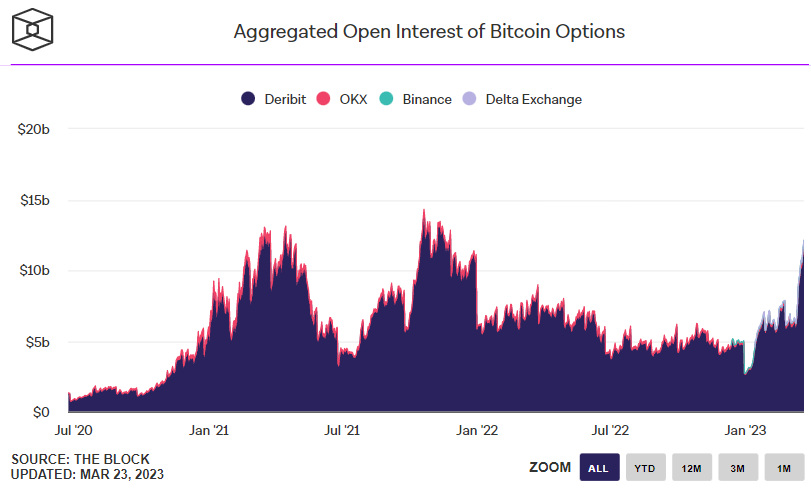

Surging Bitcoin options volumes could thus signify that institutional trading activity is on the rise. Another tell that institutions are stepping in in greater numbers/size is the recent spike in Bitcoin option open interest.

As of Wednesday the 22nd of March, open interest had spiked to $12.14 billion, its highest level since November 2021, when Bitcoin was last at all-time highs.

What This Means for BTC?

Surging volumes across spot and derivative markets send a strong signal that the latest Bitcoin rally, which has seen prices surge a staggering more than 70% on the year, is much more than just a flash in the pan.

Indeed, the surge in Bitcoin trading activity goes hand in hand with a plethora of positive on-chain signals which have a strong track record of predicting when Bitcoin will transition from a bear to a bull market, as discussed in this article.

Even prior to US bank troubles and the Fed’s resultant dovish shift adding further spice to the 2023 rally, many investors were already of the conclusion that 2022’s bear market was over.

Analysts have flagged $30,000 as the next major hurdle, while technicians have warned that 10% pullbacks remain an ever-present risk. Things will surely be choppy in the months ahead.

But positive fundamental trends (rising demand for Bitcoin as an alternative to fiat currency and amid expectations for Fed easing), positive on-chain signals (like rising network activity) and positive trends in trading (suggesting more investors stepping in to buy) should remain a tailwind for the foreseeable future.

[ad_2]

Source link