Investors Have Stopped Shorting Bitcoin for First Time in 3 Months: CoinShares Report

[ad_1]

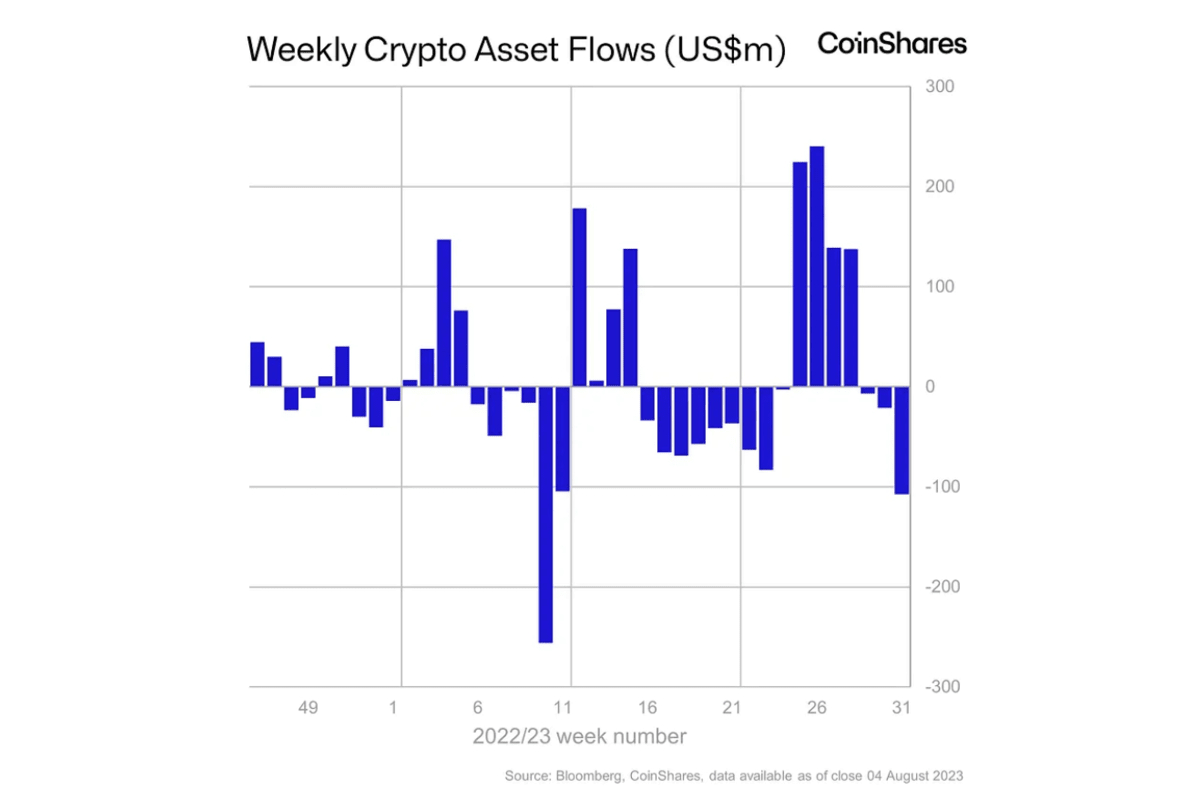

According to the latest Coinshares Fund Report, outflows into short Bitcoin (BTC) products have ceased for the first time in fourteen weeks.

This notable shift in the market suggests that significant digital asset funds are now adopting a different strategy towards the leading cryptocurrency, seeking alternative opportunities for returns.

In the report published on August 7th, 2023, titled “Digital Asset Fund Flows | Week 32,” James Butterfill, the head of research at CoinShares, unveiled that Bitcoin saw the largest weekly outflow since March; however, investors have ceased to bet on the fall of BTC.

Despite the report suggesting a temporary decline in institutional investors’ bitcoin shorting positions, they have remained active in selling.

Over the past week, these investors have divested over $111 million across various Bitcoin-related funds.

According to Butterfill, this weekly outflow is the largest seen since U.S. regulators intensified their regulatory scrutiny of the cryptocurrency industry.

Institutions are exercising caution due to ongoing lawsuits involving major platforms like Coinbase and Binance.

Moreover, the controversial classification of specific tokens as unregistered securities has added to the industry’s challenges.

The closure of several banks connected to the digital asset industry, some of which occurred under mysterious circumstances, has made the situation worse.

These factors have prompted institutional investors to adopt a more cautious approach while the cryptocurrency industry faces these complex and evolving challenges.

Bitcoin’s Potential Volatility Surge: A Closer Look at the Current Calm

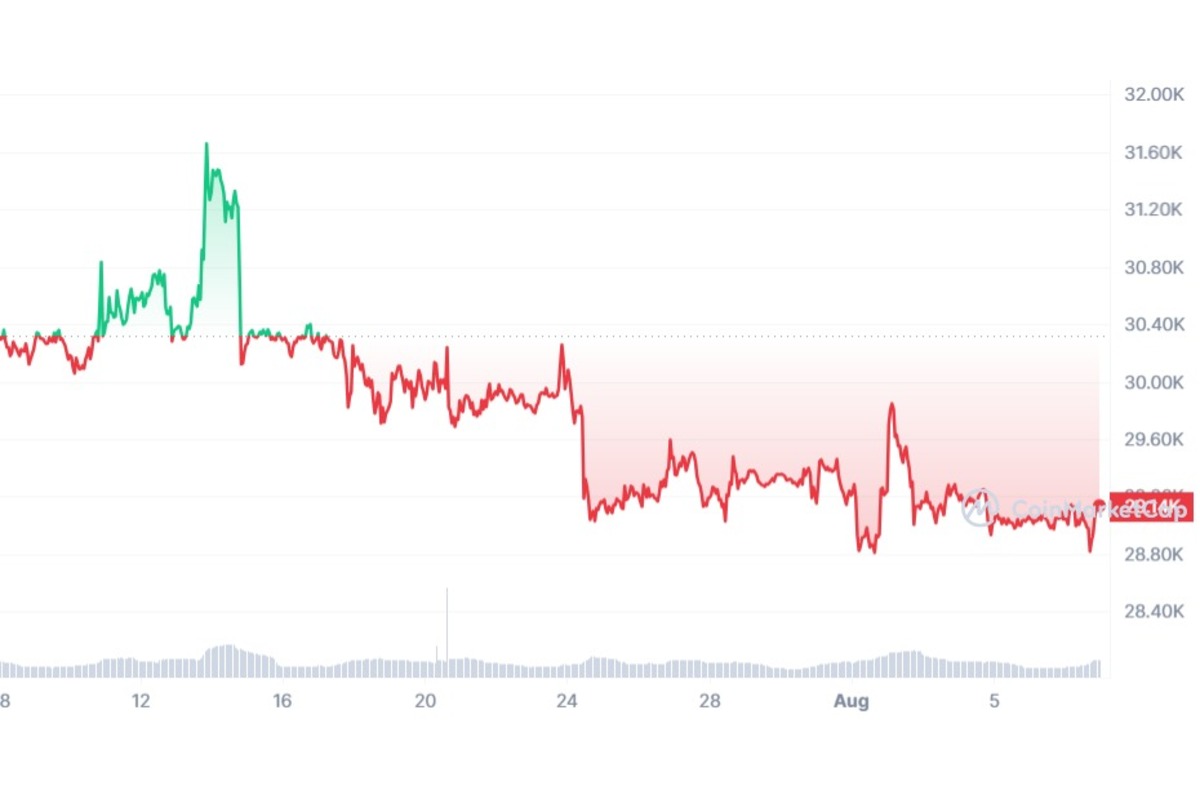

Bitcoin is currently generating significant discussion within the market, with speculations about an upcoming surge in volatility.

This speculation arises from the question: Could the present relative calm for Bitcoin be a precursor to more significant and dramatic price movements?

A recent report from K33, a digital-asset analytics group, highlights that despite recent weeks of bitcoin trading within a narrow range, seemingly unaffected by macroeconomic and industry events, historical patterns suggest a shift toward increased volatility.

Since July 24, Bitcoin, the dominant cryptocurrency in terms of market value, has mostly fluctuated within the $29,000 to $30,000 range, which is below the preceding four-week range of $30,000 to $32,000. Notably, the cryptocurrency has not experienced a daily increase of more than 4% since June 21.

Vetle Lunde, a senior analyst at K33, pointed out, “A deep crypto sleep tends to be followed by a violent wake-up.”

Lunde further elaborated, emphasizing that the current phase of exceptional stability often serves as a precursor to heightened volatility once it eventually resumes.

He added, “My short-term thesis is that the market’s volatility pressure is about to climax and that an eruption is near.”

While Bitcoin’s current trading behavior might seem tranquil, historical patterns and expert analysis suggest that increased volatility could be on the horizon.

Persisting Faith in BTC Shorting: Traders Embrace Volatility Despite Recent Trends

Despite the recent decline in Bitcoin shorting, highlighted in the Coinshare report, certain crypto traders still prefer shorting volatility.

In his most recent market analysis, Greg Magadini, the director of derivatives at Amberdata, stated, “Upside volatility likely remains far away unless BTC can reach new year-to-date highs.

The clearest catalyst for this currently revolves around a BTC spot ETF.”

He further emphasized his viewpoint, noting, “I continue to believe that, given the current circumstances, leaning toward the short-volatility bias (in the near term) is the most reasonable approach.”

In essence, while some traders may have reduced their Bitcoin short positions, there remains a sentiment among certain experts to maintain a cautious stance, anticipating limited upside volatility unless specific market catalysts, such as a BTC spot ETF, come into play.

[ad_2]

Source link