The Resilient Revolution of the World’s Largest Digital Asset

[ad_1]

The story of Bitcoin (BTC) is one of resilience. It has faced scorn and skepticism, booms and busts, yet continues to thrive. Recent bank collapses and a struggling Federal Reserve has accelerated its impact on global finance.

Bitcoin is now a serious challenge to conventional financial systems. Its decentralized nature and strong performance have garnered interest from investors and advocates alike, who seek a more stable and fair monetary framework. As Bitcoin continues to gain traction, it highlights the weaknesses inherent in traditional financial systems. This shift in perception is driving many to reconsider the very foundations of money and explore alternative solutions.

The Fragile Foundations of Fiat Currencies

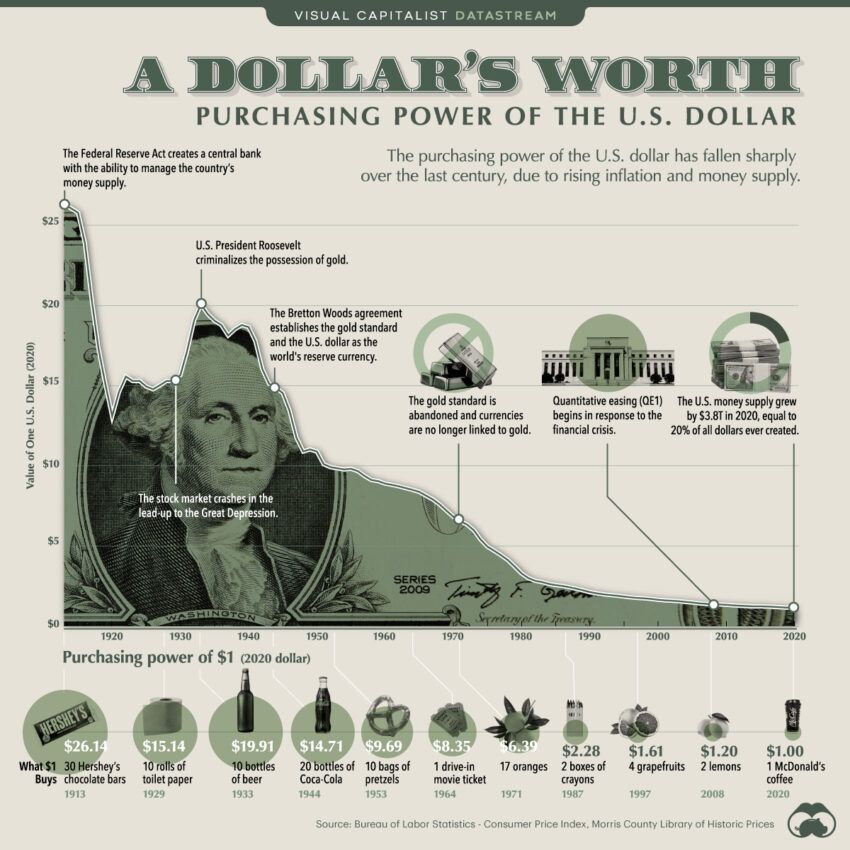

Fiat currencies face many challenges. Inflation, economic crises, and political meddling are just a few. Over the past decade, the US dollar has experienced a significant decline in purchasing power.

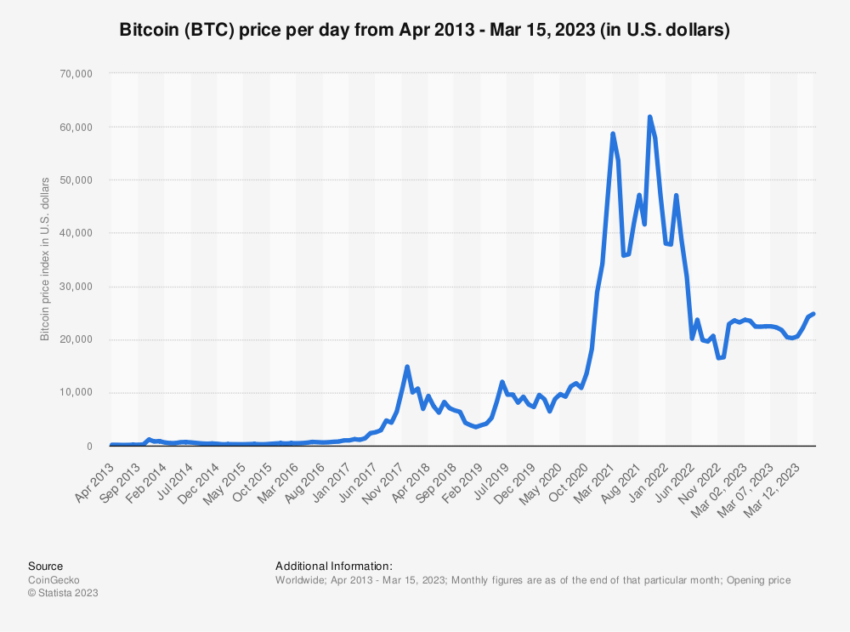

In contrast, Bitcoin has appreciated in value, with its price skyrocketing from a few cents in 2010 to tens of thousands of dollars in recent years.

Historically, traditional assets like stocks, bonds, gold, and real estate have been considered safe havens. However, Bitcoin’s performance has outpaced these assets over the past decade, making it an attractive alternative investment. As the world increasingly sees Bitcoin’s potential, it paves the way for a new era in finance, redefining the concept of value and investment.

The Dark Side of Centralized Finance

Central banks and governments have not been immune to corruption. Mismanagement, too, plagues these institutions. Bitcoin’s decentralized nature offers an alternative. It provides transparency, efficiency, and logic.

While no system is immune to bad actors, Bitcoin’s decentralized structure reduces the potential for corruption. The network relies on consensus and cryptography, which ensures that participants follow the rules and that transactions remain secure.

As we explore the potential of Bitcoin to disrupt traditional finance, it is crucial to examine the ways in which centralized systems have failed us in the past. By doing so, we can better understand the driving forces behind the adoption of decentralized digital currencies like Bitcoin.

War and Fiat Currency Debasement

Fiat currencies have historically played a significant role in financing wars. Governments often resort to money printing to fund military conflicts, leading to currency debasement and inflation. This devaluation of money enriches the printer – typically the central bank – at the expense of citizens, whose purchasing power declines.

For instance, during World War I and World War II, many countries, including the United States, Germany, and the United Kingdom, experienced high inflation rates due to extensive money printing to fund their war efforts. In more extreme cases, such as the Weimar Republic in the early 1920s or Zimbabwe in the late 2000s, hyperinflation occurred due to unchecked currency printing, leading to devastating economic consequences for citizens.

Bitcoin’s decentralized nature and limited supply offer an alternative to this inflationary spiral. As a deflationary currency, it is not subject to the whims of a central authority that can arbitrarily create more units. This characteristic provides a degree of insulation against the debasement that often accompanies war financing and other instances of government monetary expansion.

As the world acknowledges Bitcoin’s potential benefits, it’s important to consider the pushback it faces from powerful entities. This resistance highlights the struggle between central control and decentralized financial freedom.

Governments and Central Banks

Despite Bitcoin’s potential, central banks and governments attempt to curb its adoption. Through regulation and restrictions, they try to maintain control. However, Bitcoin’s resilience shines through, as it continues to grow and flourish.

Some governments have even launched their own digital currencies. Central bank digital currencies (CBDCs) aim to replicate some of Bitcoin’s features. However, they lack true decentralization. The control remains with central banks, perpetuating the same problems faced by traditional finance.

Bitcoin’s Value: More Than a Unit of Exchange

Bitcoin’s limited supply and resistance to censorship make it a valuable asset. Its decentralized nature and cryptographic security allow users to transact freely without interference. For many, Bitcoin represents more than a currency—it is an expression of freedom.

As the global financial landscape evolves, Bitcoin’s role in it becomes increasingly important. Its decentralized structure and the freedom it offers make it an attractive alternative to the current system, especially for those concerned about privacy and autonomy.

Bitcoin’s Proponents: Voices of Decentralization and Empowerment

Several influential individuals have become vocal proponents of Bitcoin, advocating for its potential to empower individuals and challenge the status quo. Some of the most prominent include Michael Saylor, Erik Voorhees, and Max Keiser.

Michael Saylor, the CEO of MicroStrategy, has been a significant advocate for Bitcoin. Under his leadership, MicroStrategy has invested heavily in the cryptocurrency, viewing it as a superior store of value to traditional assets. Saylor emphasizes Bitcoin’s potential as a hedge against inflation and the risks associated with centralized financial systems.

Erik Voorhees, the founder, and CEO of ShapeShift, has long been a proponent of Bitcoin and cryptocurrencies in general. Voorhees emphasizes the importance of financial privacy and the potential for cryptocurrencies to disrupt the traditional banking system, providing greater control and autonomy to individuals.

Max Keiser, a financial broadcaster and host of the “Keiser Report,” has been an outspoken supporter of Bitcoin for years. Keiser’s advocacy focuses on Bitcoin’s role in challenging central banks and governments, which he believes engage in destructive monetary policies that erode the wealth of citizens. Keiser currently advises the president of El Salvador on that country’s Bitcoin adoption policies.

The Philosophy of Bitcoin: Empowering the Individual

Many people believe that the solution to issues surrounding state-controlled money lies in a new form of non-governmental currency: cryptocurrencies. Bitcoin, the first and largest of these, emerged after the 2007-2008 financial crisis, becoming operational in January 2009.

Created by the pseudonymous Satoshi Nakamoto in a 2008 white paper, Bitcoin is a digital currency with a fixed supply, contrasting sharply with fiat currencies. It has no central owner or governing entity; rather, it operates on a voluntary, global network using open-source software.

Importantly, this structure separates it from both states and banks.

At its core, Bitcoin’s philosophy revolves around decentralization, individual sovereignty, and resistance to censorship. It seeks to empower individuals by providing them with greater control over their own financial resources, free from the constraints and potential abuses of centralized financial systems.

However, these tenets stand in stark contrast to the traditional financial system, which prioritizes the interests of the state and large financial institutions over those of individual citizens. By offering an alternative means of storing and transacting value, Bitcoin has the potential to shift the balance of power, giving individuals greater control and autonomy in their financial lives.

“The number of industries, communities, habits, traditions, and even interpersonal interactions that Bitcoin has the potential to revolutionize is massive.” – Erik Voorhees

Unstoppable Bitcoin?

Bitcoin’s resilience has been tested time and again. It has faced skepticism, regulation, and fear. Yet, it remains an influential force in the global financial landscape. Its decentralized nature, immunity to debasement, and potential to combat corruption have set it apart.

Yet, it is important to approach Bitcoin with a balanced perspective, considering both its potential benefits and the challenges it faces. As the world navigates the crypto revolution, Bitcoin continues to play a significant role in shaping the future of finance.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link